You're Kidding....Aren't You?

Imagine you own a large physical network like a data network. Suppose this network served a mission-critical function similar to your corporate network. You could not "live" without it. Now suppose your network administrator came to you and made the following statements regarding delivery of data from your network nerve center to your desktop computer:

We are losing 7.5% of all data shipped across the network...it just evaporates as a result of the network design ("Evaporation");

We are losing around 2.5% of all data shipped across the network to theft ("Theft"). We are not sure who is stealing it; and

We are losing around another 6% of all data shipped across the network because your computer doesn't want to use the data efficiently ("Apathy").

You would consider these statements fairly unbelievable. You would wonder how your network could possibly lose nearly 16.0% of all the data shipped across it. You think to yourself, "if General Motors lost one out of every five cars it produced somewhere between the factory and customer they would go out of business instantly." The prices they would have to charge to cover these losses and still produce a profit would be non-competitive. Once you got off the floor the next words out of your mouth would be, "you're fired."

As unreal as this may all sound...if the statements above were repeated by your local power company they would be fact. Almost 16.0% of the electricity produced in this country is victim to these types of losses. In analyzing the components of US electricity loss, we can identify that:

- Evaporation (as defined) is a function of choices we've made regarding system design (1);

- Theft (as defined) is a function of the absence of good visibility across the system down to the power-user level (2); and

- Apathy (as defined) is a function of human habit (3).

Maybe There's a Silver Lining

Now here's what I like about these causes - they all sound like problems that can be dealt with by humans. This suddenly relieves me from my fear that the Sun is going to burn out tomorrow and that we are otherwise in some irreversible downward energy spiral caused by years of gluttony and neglect.

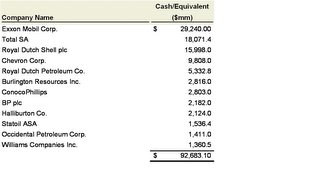

Approximately 86% of the coal in the US is used to produced 50% of the electricity  (http://www.clean-energy.us/facts/coal.htm). If we were smart enough to cost-effectively eliminate the 16.0% waste referred to above, demand for coal by volume could conceivably decrease by 15% (all other things held equal). Imagine what would happen to the price of coal. What collateral impact would this have on the price of natural gas (which is also used in substantial volumes to produce electricity - about 18% of all power produced)? Just as an example of market tightness, the table to the right reflects the impact on prices of a decrease in the supply of US oil during the fall of 2005. A 20% peak decline in supply resulted in a 35% peak increase in gasoline prices - just an example.

(http://www.clean-energy.us/facts/coal.htm). If we were smart enough to cost-effectively eliminate the 16.0% waste referred to above, demand for coal by volume could conceivably decrease by 15% (all other things held equal). Imagine what would happen to the price of coal. What collateral impact would this have on the price of natural gas (which is also used in substantial volumes to produce electricity - about 18% of all power produced)? Just as an example of market tightness, the table to the right reflects the impact on prices of a decrease in the supply of US oil during the fall of 2005. A 20% peak decline in supply resulted in a 35% peak increase in gasoline prices - just an example.

I am NOT saying that any of this electricity waste avoidance could happen, should happen, or will happen. I am simply observing that there seems to be substantial room to contemplate conservation and efficiency in the world of energy. Now what I am saying is that if solutions are found to address these issues then investing in these solutions will make money long before alternative energy. I've seen this happen before.

When we had an energy crises in the early 70s (see Arab Oil Embargo), investors did not make a killing in solar and wind farms and other renewables - I don't know anyone that did. They didn't because there was a lot of fat (i.e. waste) in the system. This fat was shaken out in the form of better gas mileage, new-design lightbulbs, improved home insulation, power management systems, etc. Change to efficiency is how money was made by stockholders (e.g., Japanese car manufacturers took a substantial share of the US market by manufacturing cars with better mileage) not new sources of energy per se....more of a market shift than market creation.

Most times investment success in technology reflects "incremental" change rather than"displacement". Technology investments that displace existing systems rather than supplement them are difficult to capitalize upon because they run against human habit and vested economic interests. So when I observe material levels of "waste" combined with a refreshed national energy concern, I see an opportunity to invest in waste reduction more than "alternative energy" per se. This is where I think the money is going to be made. At a level, this perspective puts me at odds with a lot of other investment funds.

Endnotes:

(1) http://climatetechnology.gov/library/2003/tech-options/tech-options-1-3-2.pdf

(2) Just about every utility in the US relies heavily on theft reporting by upstanding customers to identify theft of electricity (just "google" electricity theft). More advanced systems use some form of SCADA systems to watch their geography for irregularities in consumption. The balance of theft is believe to be identified by observation of meter tampering, etc.

(3) http://www.consumerenergycenter.org/homeandwork/homes/inside/appliances/small.html