While I can't absorb all that is broadcast at me I do try and listen keeping some and discarding some. Some of this information is not only good for guiding children it is, in my judgment, good for the reader - me and others in my position. One thing I contemplate regularly (that is discussed in the "Better Parenting" literature is the notion of adolescent development and instant gratification). Based on my readings it seems fair to say that parenting pundits believe that instant gratification experienced regularly may have long-term negative consequences (see the famous "Marshmellow Experiments" (http://en.wikipedia.org/wiki/Deferred_gratification. ) Common sense seems to support this.

A few months ago I bought an iPod. Over these few months I have noticed a change in my alertness regarding music. I used to hear a song and perhaps think (I like this song and if I can remember - I might go to the record store and purchase the CD). I would then abruptly forget about it. With an iPod...I operate differently. I hear a song that I would like to own and don't forget about it. I burn the notion of buying that song in my mind because I know I can go on-line and buy it though iTunes. I know that if I just hang on long enough to get in front of my computer...I am going to get that song. iPod has thus changed my behavior. I can, relatively speaking, receive a form of instant gratification. So the possibility of instant gratification has changed how I occupy my time and use my brain cells. As a side note...I haven't seen a record store in two years.

A Closer Examination of Instant Gratification

Pursuit of instant gratification is more prevalent than ever. The world can get you things and tell you things real fast. There are many examples in the information technology world.

A Positive Example - Some types of instant gratification certainly are good. Web MD (www.wedmd.com) helps you diagnose your symptoms without the anxious process of going to see a doctor (please do this at your own risk).

A Negative Example - Some types of instant gratification are addictive and bad. YouTube (www.youtube.com) is conceivably such an example. This is a website where one can conveniently posts homemade videos. It works sort of like this...I put videos up myself on YouTube (as millions of others have)...I then wait to see how many views I have had and then use this as a measure of my self worth. Google just decided this social/emotional feedback loop was worth about $1.6 billion. It is bad in my judgment because I perceive it to place the power of determining one's self-image into the hands of others and away from the self. "My opinion of me is based on what I perceive others may think of me......"

Yes...... we are a culture of instant gratification...the addictive character of instant gratification is why we talk too often on our cellphones, try out on American Idol, do a double take on advertisements that promise a graduate degree in 9 months, and otherwise quit so frequently when things get too hard to complete.

What Does This Mean?

Yes...I have noticed above...there are good and bad forms of gratification. While I can't mathematically weigh whether or not higher speed gratification is, on the whole, good or bad...I do believe that instant gratification drives a greater appetite for more instant gratification. It goes faster and faster. A result of this is that obtaining and using the tools for instant gratification occupy more of my focus...as a result of feeding my addiction...I spend more time doing and less time thinking...

Believe it or not...this has ramifications on, among other things, the products and services we demand and on the way software is designed and networks utilized (I had to work this in). Some basic beliefs of mine:

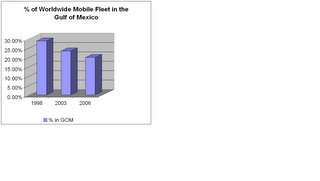

- By virtue of our cultural changes....software and networking systems that provide more instant gratification will be more attractive to potential buyers and win market share. This can come in the form of better visualization, faster visualization and analysis (real-time), and ease of deployment. It seems obvious that the faster the information...the more demand for the information technology.

- End Users will be more into self provisioned software...in other words...they will do a search on the web..find what they think they need that provides requisite business functionality...download and start using it (credit Tyson Weihs) . This is happening all around you.

- Customization will have to wait. End Users will end up trading functionality for immediacy. If a software package does 60% of what I need but is available today vs. next year (as might be the case if run through IT)...then so be it. Greater functionality will be built later.

- As a result of the point immediately above...software will become more disposable. 60% capable software will survive for awhile then be trashed while a more competent system is procured/deployed. Think of this...software will become more disposable...this is starting to sound like service oriented architecture (SOA)...use the service...dispense with the service.

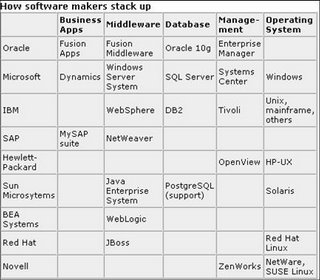

- Some of this will mean that software will be broken down into smaller pieces contrary to the huge monoliths such as SAP and Oracle. So we are sort of going back to best of breed.

These statements reflect a necessary change in product architecture and philosophy, marketing message, pricing strategy, and requisite product functionality.

Self Check

Nonetheless....I am sure that more and more of my time and braincells will be directed toward the pursuit of instant gratification...I need to make sure I stop and breath to make sure that I do things like calculate and reason. Someone please contact George Orwell.