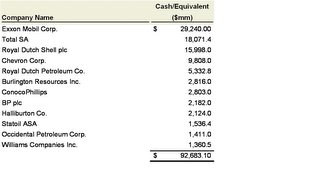

I like this table. Its data is not really subject to interpretation...I can't turn it inside out and bend its meaning to reflect my own experiences (sorry for the existentialism) making it unrecognizable to you. It is cash. The table reflects cash deposits of several energy companies. The current rate of cash accumulation in the energy sector is fairly close to mind blowing - the ten largest companies have nearly $100 billion of the stuff on their balance sheets (see table above). It feels like a Ron Chernow novel. Good for them. For anyone who was around in the early 80's oil bust..it is a well deserved payday.

A Question Worth Asking

Cyclicality of the energy industry is inextricably embedded in its DNA. Today oil closed at $65 bbl. However in inflation-adjusted dollars oil is inexpensive relative to its long-term history. The recurring news from the industry creates the appearance that these are the best of times for energy shareholders - all times. It makes me wonder...under the current set of extraordinary economics (as defined by cash accumulation), why would any energy company waste its time ever thinking about and spending money on any sort of technology that wasn't focused on extracting more oil sooner - why bother? Interesting question.

A Little Hedonism

I believe that most humans would likely not continue their employment relationship if they were so fortunate as to win the powerball lottery. So if the energy sector has in fact won this lottery (repeatedly)...then why would it lift a finger to do anything else but print the money (i.e. such as invest in more rote IT - based on human nature...it doesn't quite make sense)?

- Hypothesis: Maybe they don't believe the lottery is going to last. Maybe recent history has not played the antagonist's role sufficient to erase memories.

What's the Message?

Position A (downcycle) - The energy sector has put off self-improvement (capital investment) in many areas for years - why---it didn't have the money. Now it has the cash resources to plan and invest to make operations more cost efficient. The distribution of spending reflects this (See "Market Research from Energy Insight" in this web log). Is the industry's history speaking to us - is it saying "we are planning for the downcycle?" There must be at least a partial "yes" to this question. The energy industry is mature and extremely cost-conscious and must believe it is going to get a return on investment (i.e. there is going to be a downcycle which renders the investment fruitful) sufficient to redirect dollars away from the drillbit directly or as dividends from shareholders as the case may be.

Position B (volatility management) - The energy industry is using information systems to obviate huge hiring (cost) increases where it can in this upcycle - interesting. I also hear that folks want to avoid the pain of letting employees go in the next downcycle and IT is likewise assisting this aim by avoiding the need for more bodies (which may be terminated later).

Whether it's Position A and Position B, either one reflects trace elements of risk...the risk that things may be bad again. Right, wrong or indifferent the industry is starting to say these things and spend for these stated reasons (in many areas). The industry is saying things with its check book......we are trying to interpret what it is saying.

No comments:

Post a Comment